近日,全球知名调研机构Counterpoint发布了2023年Q1全球蜂窝物联网模组和芯片的追踪研究报告。开云手机官网入口凭借其在NB-IoT和4G Cat 1 bis模块方面的出色表现进入了中国前五大模块供应商名单。

Counterpoint Research是国际知名的市场研究机构,提供有关移动技术、消费电子和相关领域的市场洞察力和数据分析,研究范围包括智能手机、智能家居、物联网、无线通信等领域。是全球物联网行业最具权威的行业分析咨询机构之一。

以下文章转载自:Counterpoint

原文链接:https://www.counterpointresearch.com/iot-module-shipments-q1-2023/

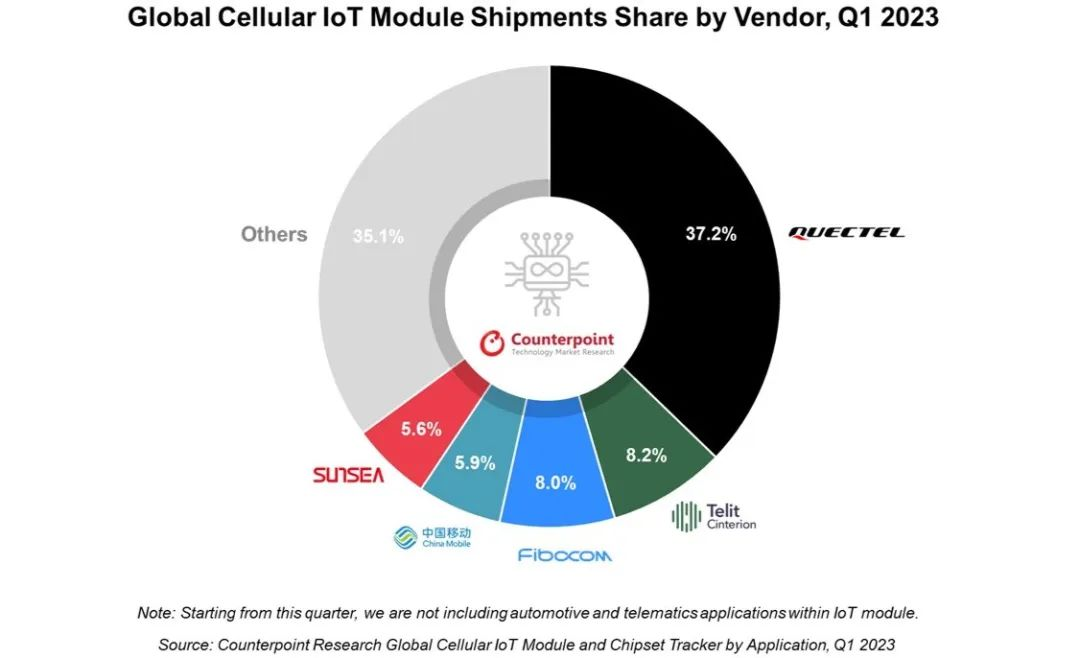

Quectel maintained its dominant position globally and in China, the largest IoT module market.

The newly merged entity Telit Cinterion climbed to the second spot. It was followed by Fibocom.

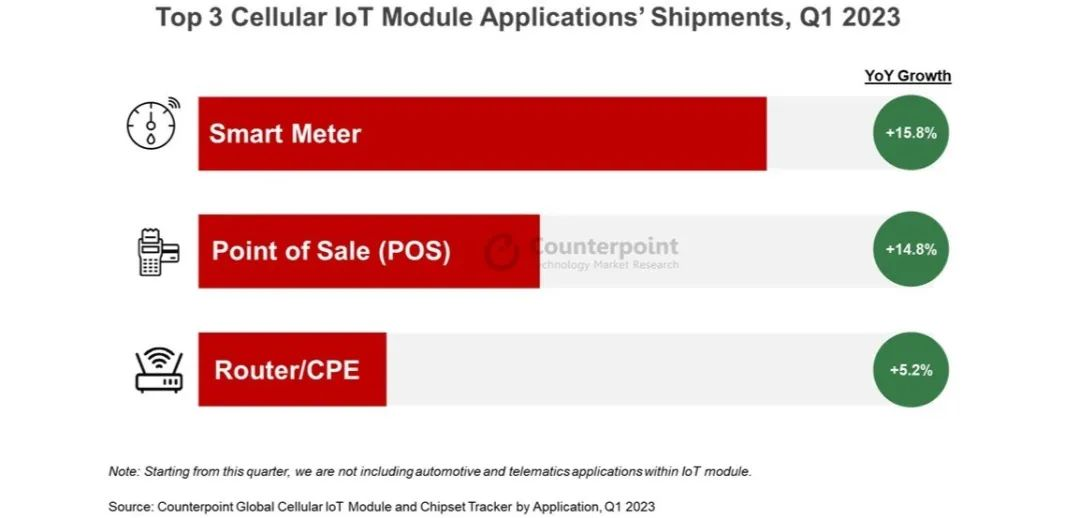

The top three applications – smart meter, POS and router/CPE – formed more than half of the total shipments.

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Taipei, Seoul – July 19, 2023

Global cellular IoT module shipments (excluding automotive embedded and telematics modules) remained flat in Q1 2023 when compared to the same period of last year, according to Counterpoint’s latest Global Cellular IoT Module and Chipset Tracker by Application report. However, when compared to Q1 2020, the shipments more than doubled in Q1 2023. Quectel, Telit Cinterion and Fibocom captured more than half of the total cellular IoT module shipments in Q1 2023.

The demand for cellular IoT in applications such as smart utilities, payment terminals and FWA CPE routers and gateways remained healthy during the quarter. But the demand for cellular modules across enterprise digital transformation and industrial projects remained soft. With current uncertain market scenarios, enterprises are being cautious with their expenditures. China and India registered positive growth in shipments while the US, Latin America, Japan, South Korea and Eastern Europe saw a YoY decline.

Commenting on the market dynamics among cellular IoT module OEMs, Senior Research Analyst Soumen Mandal said, “The cellular module market is going through a unique transition both regionally as well as technologically, with the two being intertwined. Low-power and low-cost technologies such as LTE-M, NB-IoT and LTE CAT-1 (and 1 bis) are seeing rapid adoption in China. This has driven a flood of chipset and module providers catering to the strong push from all the stakeholders for the adoption of cellular IoT at scale. On the other hand, we are seeing rapid consolidation and exits of cellular module vendors in markets outside China, where the technology adoption is fairly fragmented and varies across geographies. 5G will further drive consolidation in a couple of years. Therefore, these underlying dynamics are shaping the competitive landscape differently in China and the rest of the world.”

Globally, Quectel led the cellular IoT module market in Q1, followed by the newly merged entity Telit Cinterion, formed after the acquisition of Thales’ cellular IoT module business by Telit last year. The third spot was taken by another China-based fast-growing player Fibocom. Together, these three players held over half of the market’s shipments in Q1. Among the leading IoT module vendors, Neoway demonstrated the highest growth, followed by u-blox. The world’s largest IoT telecom operator in terms of connections, China Mobile, maintained its second position in the Chinese market. Among other vendors, Unionman entered the top-five module vendors list in China, thanks to its impressive performance in NB-IoT and 4G Cat 1 bis modules.

Quectel maintained its leadership position in its domestic market China as well as globally. Its lead in the Americas, India and MEA regions also contributed to its strong position. All this helped Quectel widen its shipment share gap with the nearest competitor. The company’s strong performance is being driven by its broader, integrated portfolio and strong on-the-ground Field Application Engineering (FAE) support.

Telit Cinterion climbed to the second position in the global market after the merger, helping the erstwhile Telit bridge the gap with Quectel in the international market excluding China. Telit Cinterion is now one of the largest Western IoT Vertically integrated to some extent, Telit Cinterion enjoys a strong position in high-value North American and European markets and will further expand in other high-scale markets in the near- to mid-term.

Fibocom experienced impressive growth in Q1 2023 to stand out among the top three global players. Its presence in the router/CPE and POS segments helped Fibocom enter the top-three list for China and the top-five list for international markets excluding China.

Among the top 10 applications, the smoke detector experienced the highest growth, followed by the residential and smart meter segments. The top three applications in terms of shipments – smart meters, POS systems and router/CPE solutions – collectively contributed to more than half of the cellular IoT market.

Commenting on the IoT market outlook for 2023, Associate Director Mohit Agrawal said, “The global cellular IoT module market is expected to witness subdued growth this year as the 4G/5G cellular module growth remains muted due to higher ASP. However, we expect the demand for cellular IoT modules to rebound in the coming years. The mass production of affordable 5G RedCap-based modules, scheduled for the end of this year, is expected to drive the adoption of 5G in the IoT module market. Applications such as smart meters, POS, and router/CPE solutions will play a crucial role in driving both the value and volume of the IoT module market in coming years and will be key focus segments in the near- to mid-term. In the longer term, the demand for IoT modules will be driven by massive IoT applications and the industrial segment. It is projected that IoT module shipments will grow at a compound annual growth rate (CAGR) of 11% between 2023 and 2030.”

* The IoT module here encompasses all applications supported by cellular IoT modules, except for automotive and telematics applications.

For detailed research, refer to the following reports available for subscribing clients and individuals:

Global Cellular IoT Module and Chipset Tracker, Q1 2020-Q1 2023

Global Cellular IoT Module and Chipset Tracker by Application, Q1 2020-Q1 2023

Counterpoint tracks 1,500+ IoT module SKUs on a quarterly basis and provides forecasts on shipments, revenues and ASP performances for 80+ IoT module vendors, 12+ chipset players and 18+ IoT applications across 10 major geographies.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.